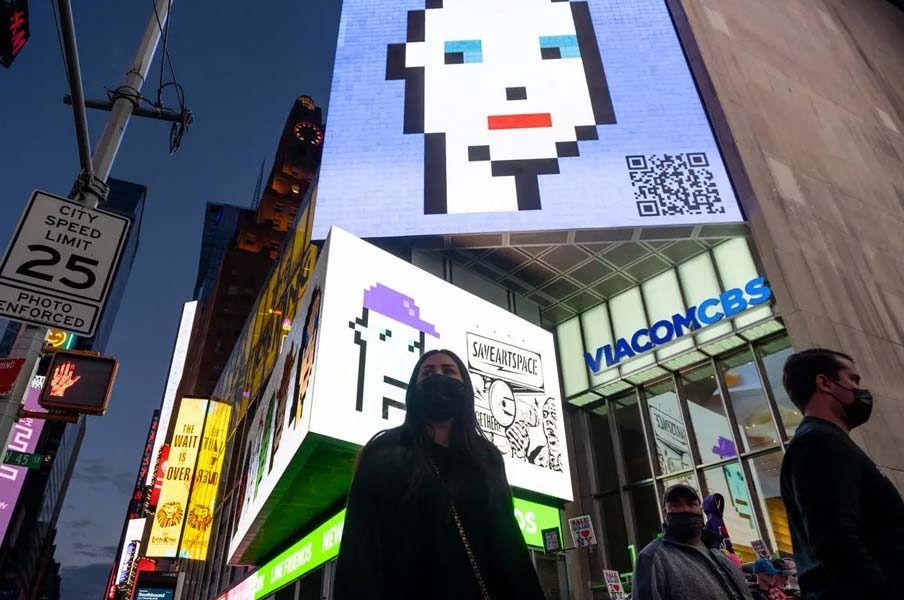

One of the biggest financial booms in the past 12 months came in the form of NFTs or non-fungible tokens – digital assets to be purchased and traded via online marketplaces. The most popular NFT collections have featured eye-catching artwork, including cartoon apes sporting an array of different fashion items. However, the latest price and sale trends relating to NFTs tend to suggest they may already be going out of fashion themselves…

At the height of the NFT craze, daily average prices leapt from just $128 all the way to almost $4,000. By January, the most popular online marketplace, OpenSea, recorded the best month in its history, while average NFT prices also climbed to an all-time high of $6,900.

However, since then, NFT prices and sales have been on a steady decline. Compared to the daily sale total of $160.2 million on January 31st, the value dropped all the way down to $26.2 million by March 3. Not only this, but the average selling price of each individual NFT also dropped from that $6,900 high on January 2 to under $2,000 in March.

Primary sales have also dropped from 26,000 per day at the start of 2022 to under 3,200 in March, while secondary sales are down from 38,000 to around 7,900 in the same time frame. Even the most popular NFT on the market, A Bored Ape Yacht Club, have suffered a noticeable dip in recent times. Even though they boasted $224,028 of transactions on one day in early March, this was still over a $67,500 drop compared to the end of January. To make matters worse, this trend indicates the prices and sales will only continue to drop as 2022 ticks on.

There are a number of contributing factors to the fall of NFTs, including the Russian invasion of Ukraine. Since Putin ordered his troops across the border, average non-fungible token prices have dropped by approximately 30%. Not only this, but the easing of COVID restrictions around the world, and increased regulations on NFTs have also likely contributed to the downfall. For example, the Securities and Exchange Commission in the US is currently reviewing and scrutinizing NFT creators and marketplaces.

Having said that, senior data analyst at DappRadar, Pedro Herrera revealed: “Trading volumes are down in general, but the demand measured by the number of unique traders and sales count is increasing. So while we’re seeing less volume, there’s more activity, even though Ukraine’s conflict is definitely driving away the attention from trading.”

Chris Wilmer, who is a blockchain expert from the University of Pittsburgh, also argued: “It’s not meaningful to characterize a concept as a financial bubble. NFTs aren’t in a bubble any more than ‘cryptocurrency’ is a bubble.”

“There will be manias and irrational exuberance, but cryptocurrency is clearly here to stay with us for the long term and NFTs probably are too.”

While there is certainly still interest in NFTs as a concept, political tensions, COVID factors, and increased regulations look to be pushing the industry towards a marketplace crash – even if NonFungible argued the following in a recent report:

“The trend seems more to show a stabilization on a high plateau following a speculative peak.”

Like what we have to say? Sign up to subscribe to email alerts and you’ll never miss a post.