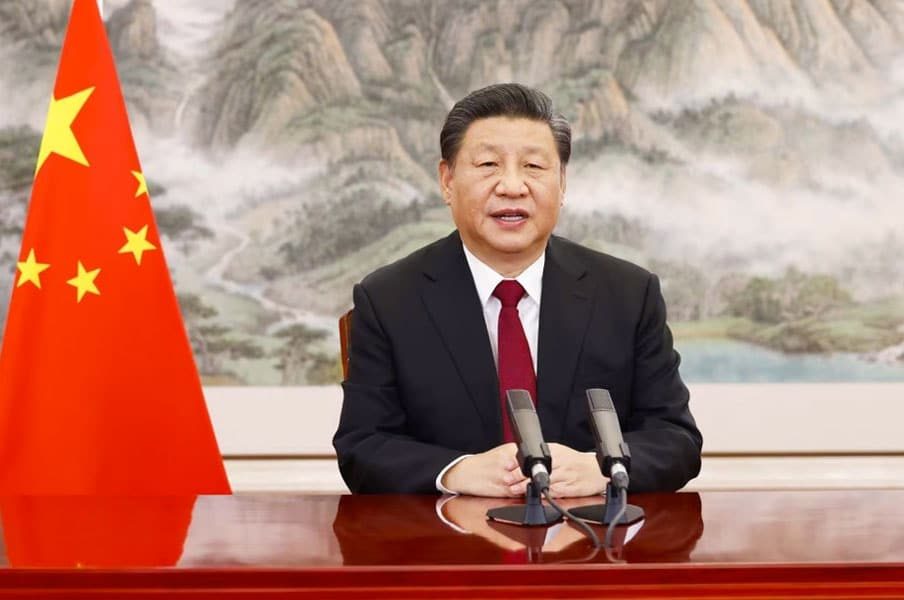

Xi Jinping delivers a keynote virtual address for the World Economic Forum. Photograph: Huang Jingwen/AP

China has warned the United States and Europe that a rapid rise in interest rates would negatively impact the world’s ability to recover from the COVID-19 pandemic.

The Asian superpower also added there would be serious economic consequences, with developing markets hit the hardest, unless central banks maintain the monetary stimulus.

Xi Jinping, the President of China, told the World Economic Forum that economic policymakers should look to work together and make plans in order to prevent a global dip, especially with inflation risks currently emerging.

He argued: “We must do everything necessary to clear the shadow of the pandemic and boost economic and social recovery and development.”

“If major economies slam on the brakes or make major U-turns in their monetary policies there will be serious negative spillovers. They would present challenges to global and economic financial stability and developing countries would bear the brunt.”

Xi was also keen to address the strained relationship between China and the US, following disagreements over trade, human rights, the South China Sea, intellectual property, and the fate of Taiwan.

He said: “We need to discard cold war mentality and seek peaceful coexistence and win-win outcomes. Our world today is far from being tranquil.”

“Protectionism and unilateralism can protect no one. They ultimately hurt the interests of others as well as one’s own. Even worse are the practices of hegemony and bullying, which run counter to the tide of history.”

“A zero-sum approach that enlarges one’s own gain at the expense of others will not help. The right way forward for humanity is peaceful development and win-win cooperation.”

This comes after China’s economy slowed to 4% between October and December 2020, and the country saw its weakest period of expansion in 18-months amidst the COVID-19 pandemic, including retail sale growth dropping from 3.9% to 1.7% in the space of 12 months.

However, China is not the only one worried about US central bank plans, with many countries across Asia, Africa and South America sharing the same rapid interest rate rise concerns.

As such, the Federal Reserve has been asked to answer questions on the easing of its quantitative stimulus programme, as well as the interest rates rising to a 40-year high of 7%. The higher the US interest rates, the higher the costs associated with dollar debts around the world.

Moving outside of the US, the European Central Bank and the Bank of England are expected to tighten their own policies on money in the next few months. This could trigger the same issues surrounding the US interest rises, especially with GBP and Euro loan repayments.

Like what we have to say? Sign up to subscribe to email alerts and you’ll never miss a post.