If there’s any season worse than winter, it’s tax.

Thankfully, the rise of cloud accounting software and automation-assisted return tools have made success near foolproof. Navigating the space can be confusing, with countless tools boasting various feature sets and prices. Still, there are only three major players you should be paying attention to; Wealthsimple Tax, TurboTax, and H&R Block. These tools will allow you to complete an accurate return with ease and within budget. We’ll explore each software in detail to ensure you’ve got what you need to make an informed decision and file your taxes online this season.

With that, let’s get started:

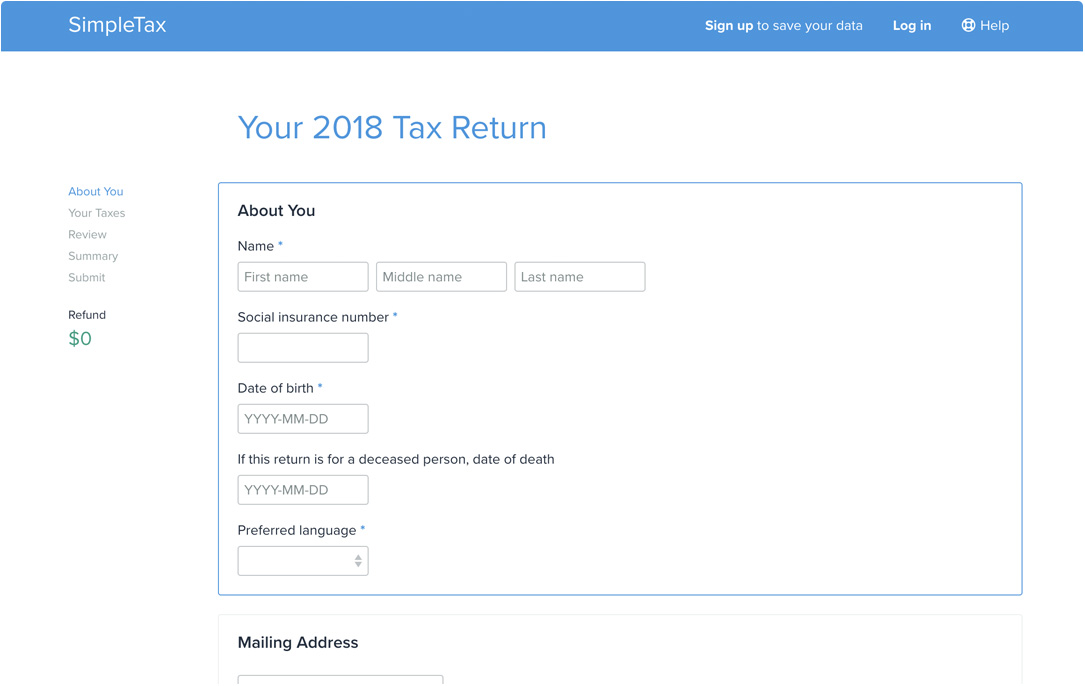

Wealthsimple Tax

Overview

As the newest edition to the online tax return ecosystem, Wealthsimple Tax (formerly SimpleTax) offers a pay-as-you-please online experience packed with core features. Return auto-filling, express notice of assessment, and instant optimized refunds can be expected. You can feel confident in the quality of your return using the detailed software tutorials and system-wide ‘Smart Search.’ New for the 2020 tax year is the ability to add advisor assistance and audit support to your return (for an additional $19.99 and $29.99, respectively).

Pros:

- User-friendly interface

- Free (but donations are encouraged)

- NETFILE certified

- Detailed product tutorials

Cons:

- Lacks capacity for more complicated returns

- Limited feature set relative to competitors

- Limited customer support

Price Range: $0-$49

Out of the three options discussed, Wealthsimple Tax is the only one that allows for user-decided donations. This means you can spend as little as a coffee (or less) to as much as a Lamborghini (or more) for your return. Wealthsimple Tax typically recommends $19 to those who can afford it, but that’s your call.

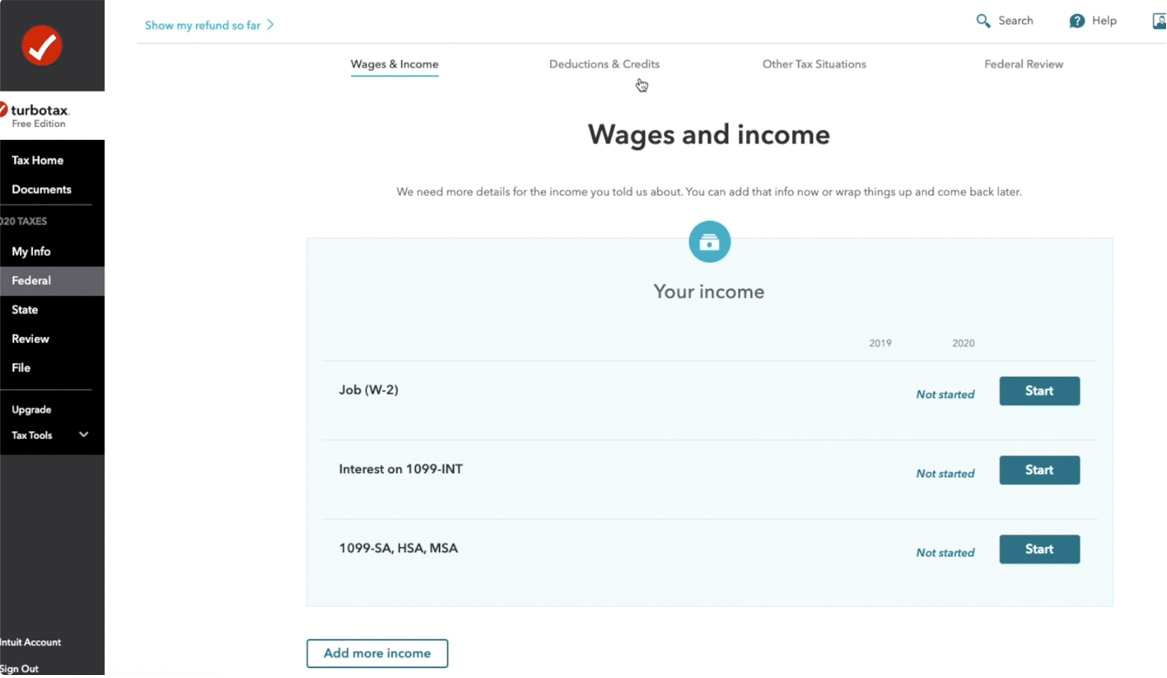

TurboTax

Overview

TurboTax is to online tax software what Michael Jordan was to the NBA. The G.O.A.T. And although competition in the space is heating up rapidly, they continue to provide value. Their guided tax experience offers a robust feature set with auto-fills (including data from previous return years), express notice of assessment, and over 400 detailed deduction and credit options to ensure maximal tax savings. The comprehensive questionnaire allows you to focus only on relevant sections and forms while still having access to a software-wide search function when necessary. There is also the ability to add expert guidance and audit support for an additional fee throughout the experience.

Pros:

- User-friendly interface

- Free option (with tiered pricing)

- NETFILE certified

- Infrastructure to handle complicated returns

Cons:

- Overwhelming to newcomers

- Live support is expensive relative to competitors

- Lack of price transparency

Price Range: $0 – $99+

TurboTax pricing is based on your specific needs. The most basic returns start at $0, with personal returns priced at $19, self-employed at $44.99, and premiere/business higher still. They offer additional services like expert-support ($69.99) and audit protection ($59.99), as well as ‘full service’ options for those looking to go completely hands-off.

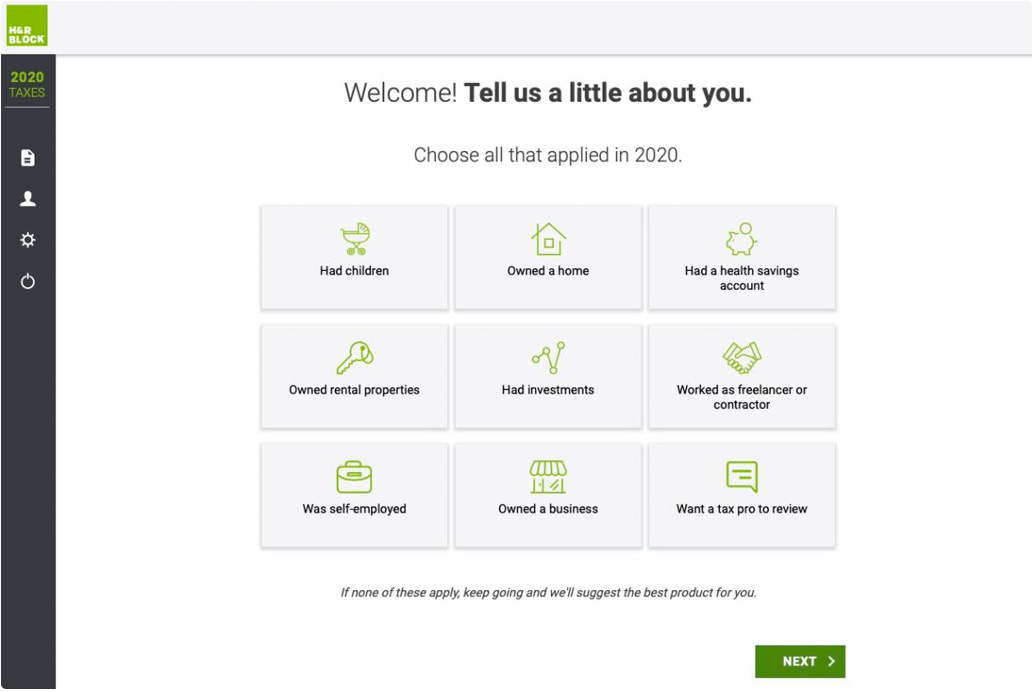

H&R Block

Overview

Although a long-term leader in the face-to-face tax space, H&R Block is one of the newer kids on the online tax return block. They bring to the table all of the core return features you would expect, including return auto-filling and importing, express notice of assessment, detailed deduction options, NETFILE, and more. Their modern interface makes moving through sections and forms seamless, and any roadblocks hit can be easily managed with their live chat support or advanced ‘SmartSearch’ function. Similar to its alternatives, you’ll have the ability to add audit protection and an expert return review for an additional cost.

Pros:

- User-friendly interface

- Free option (with very affordable tiered pricing)

- Live online support

- Infrastructure to handle complicated returns

Cons:

- Overwhelming to newcomers

- Live support is expensive relative to competitors

- Lack of price transparency

Price Range: $0 – $29.99+

For the first time since launching in 2016, H&R Block’s online tax software is free for those looking to handle things entirely on their own. You can upgrade to the Assistance version, with advanced tax tips and expert support, for $19.99 or the Protection version, including audit protection and digital return storage, for $29.99.

Closing Thoughts

There’s nothing better than a head-ache-free, error-free tax season. All three of the software options outlined in this article, Wealthsimple Tax, TurboTax, and H&R Block, will help you accomplish just that. Whether you’re a veteran in the personal tax return space or a beginner looking to get your feet wet for the first time, rest assured that you have the structure and support you need to make this tax year one for the books.

Like what we have to say? Sign up to subscribe to email alerts and you’ll never miss a post.